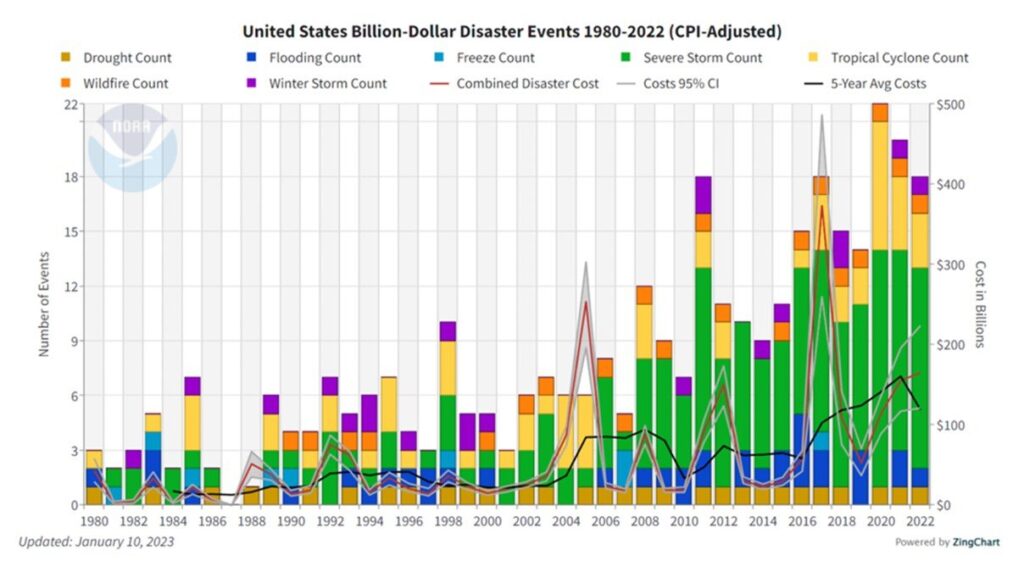

Insurance has always played a role in the real estate industry to protect assets from potential risks. Recently, due to the increasing frequency and severity of natural disasters, there has been a significant impact on insurance premiums. In 2022, the U.S. experienced 18 separate weather-related disasters, costing over $1.0 billion each and totaling approximately $165 billion in damages. These recent events have prompted a need for new practices, policies and underwriting processes for insurance companies. Based on recent data from AON, the fourth quarter of 2022 was the 20th consecutive quarter of increasing rates, unprecedented in recent history.

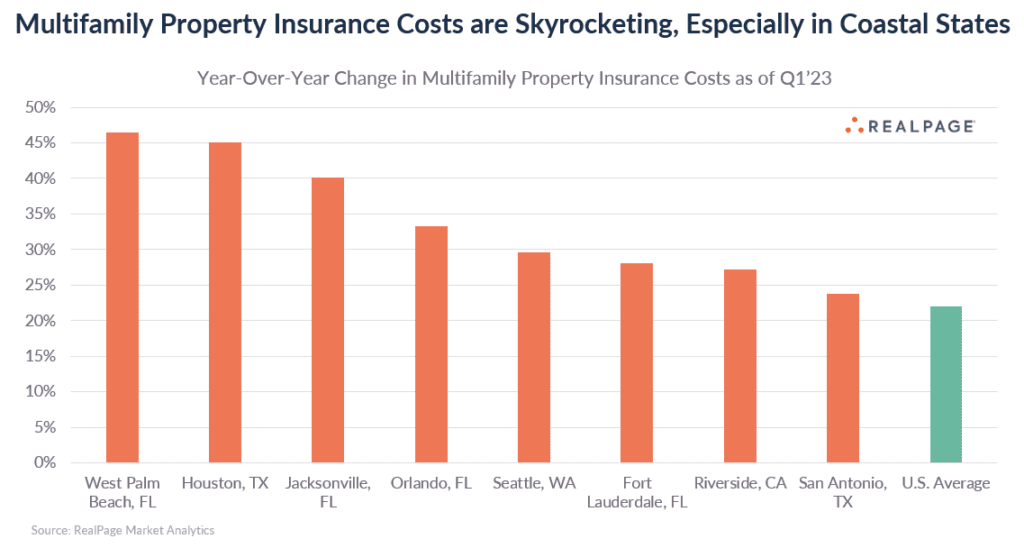

Hub predicts insurance premiums for the Multifamily sector will increase 20% on average in 2023 and as much as 200% in high-hazard zones. According to a report from USI Insurance Services, properties with less optimal risk profiles will see rate increases of 25% up to 150% in the first half of 2023. Properties that fit a “less optimal risk profile” are catastrophe exposed or non-catastrophe exposed with a poor loss history or poor risk quality. Catastrophe-exposed property with minimal loss history and good risk quality will experience rate increases between 15% to 50%. In addition to catastrophes, a second factor contributing to the premium increases is the impact of a substantial replacement cost increase because of the inflationary environment for labor and building materials.

An increase in insurance premiums reduces the NOI of a property, negatively impacting valuations and therefore returns. Alliance Global Advisors (Alliance) believes it is essential for Managers to stay informed about the role of insurance in their portfolio of assets to be prepared to navigate this evolving landscape. In this blog, Alliance interviewed several Managers active in the Multifamily sector to understand the challenges rising insurance costs are creating for their portfolios and the evaluation of new investments.

We thank Ravi Ragnauth, Chief Financial Officer at Berkshire Residential Investments, Damian Gancman, Chief Operating Officer and Chief Financial Officer at Cityview, Erin Ankin, Managing Partner and General Counsel at Waterton and Stephen Spook, Senior Investment Officer at SBA Florida for contributing to this article.

Q: What are the differences in pricing or coverage across the different Multifamily sub-types?

Damian Gancman, Cityview: At Cityview, we hold several types of insurance for our projects. Builder’s risk insurance helps protect our development projects from incidents that might occur during construction, such as water damage, arson or stolen materials. Our OCIP liability policy covers liability that could lead to water damage, such as a faulty roof that results in a leak. Our operations policy covers everything liability and property-related for existing buildings. The building’s construction type, age, geographic region and catastrophe (CAT) risk for events such as wildfires, earthquakes, drought and severe storms all impact pricing.

Q: In general, how much have you seen insurance costs increase (or decrease)? Is this dependent on any specific factors?

Damian Gancman, Cityview: While some insurance sectors are seeing market conditions soften, the property market is seeing some of the hardest conditions in decades. According to our insurance broker, Lockton, average prices have increased 25-50% without CAT coverage, and 50-100% or more with CAT coverage. At Cityview, we’ve seen an increase of 20-25% or more each year.

CAT disasters have increased not only in frequency but severity, with 18 events in 2022 that are expected to exceed $1.0 billion each in the U.S. Over the weekend of April 1 – April 2 alone, more than 800 severe weather events were reported nationwide. Fires, earthquakes and flooding are of particular concern in some West Coast markets, where several of our properties are located, which drives up premiums. High inflation, widespread supply chain issues, rising material costs and labor shortages are additional contributors to increasing costs.

Ravi Ragnauth, Berkshire Residential: The 2023 premium increase over 2022 varies from $115 to $360 per unit, around a 50% increase, depending on the location. Coastal markets have a higher year-over-year increase at approximately 60-100%.

Q: What factors make the most difference regarding increased insurance costs (asset location, vintage of asset, exposure to climate risk, etc.)?

Ravi Ragnauth, Berkshire Residential: The location was one of the most important factors that drove insurance cost changes. The type of construction was also a significant factor related to the increase in premiums. Assets with wood-frame construction saw a much more sizable increase from feedback from the broker.

Damian Gancman, Cityview: All of these factors are significant contributors to increased insurance costs.

Q: Have you seen these changes impact transaction pricing (assets on the market for sale)? If so, by what magnitude?

Damian Gancman, Cityview: The increase in insurance costs has a direct impact on NOI and operating costs, which affects transaction pricing. The magnitude varies based on a wide variety of factors, including the specific market and product type, the investor’s risk appetite and geographic variables.

Ravi Ragnauth, Berkshire Residential: Insurance has been a contributor to the change in value, however, there are other factors that are driving changes in transaction pricing, including real estate taxes and interest rates.

Q: How can real estate managers understand if their insurance premiums are considered market rate?

Damian Gancman, Cityview: It’s important to shop different policies, work closely with a broker to understand your options and diversify your portfolio as much as possible to help reduce risk. The more focused a portfolio is geographically or otherwise, the higher the risk. At Cityview, we target Opportunistic and Value-Add projects throughout the Western U.S., Colorado, the Pacific Northwest, California, Arizona, Utah and Texas, which helps mitigate our risk.

Erin Ankin, Waterton: Carriers offer a wide range of services beyond just insuring against losses. Many carriers offer risk management services to assist real estate managers in minimizing and addressing risk. For example, carriers often provide seminars or other learning opportunities regarding current risk issues and have experts available to assist with an insured’s risk questions. Carriers also assist managers in maximizing risk transfer opportunities whenever possible such as, for example, through vendor contracting requirements. Real estate managers should therefore view the carriers as their partners in risk mitigation efforts and take advantage of the myriad services they offer.

Q: What are some common mistakes that real estate managers make when selecting insurance companies/brokers/etc.?

Ravi Ragnauth, Berkshire Residential: Not focusing on the depth of experience of the brokerage team with respect to their underwriting skills and dealing with a challenging market.

Damian Gancman, Cityview: A broker’s knowledge and reach is critical. These policies can be very large, and there isn’t just one insurance company involved, so a good broker can help managers understand the intricacies of each policy, what’s happening in the market, how to mitigate risks and different policy options that might get you the same or better coverage more economically or with more controllable costs. The more volume and portfolio growth you have, the greater negotiating power you have when it comes to insurance. At Cityview we also hire a separate risk management consultant. Many brokers have claims departments that serve this function, but we’ve found value in having a separate consultant that can be an advocate when we do have claims. It’s an additional cost, but we have seen the financial benefits for our projects.

Q: What trends are you seeing across markets? Are any new insurance products emerging that you would recommend investors consider?

Ravi Ragnauth, Berkshire Residential: There is now a renewed focus on Captive Insurance Programs, given the limitations on capacity and the increases in premiums based on the recent renewals.

Q: Are you utilizing a consultant to optimize insurance costs across your portfolio? If so, who would you recommend?

Damian Gancman, Cityview: We have a longstanding, strong relationship with Lockton, but there are instances when we use other brokers as well. It’s helpful for us to compare the offerings and see what’s available. We think it is critical to understand the market and stay up to date on the latest developments and trends, and a good way to do that is to be continually talking to different industry professionals.

Erin Ankin, Waterton: In addition to employing a broker, we do use an insurance consultant to assist us in ensuring that we are obtaining the right coverage at the right price. In the increasingly challenging insurance market, it is important to have an experienced team evaluating coverage from every angle and working with the carriers so that the bound insurance program sufficiently meets the organization’s insurance needs.

Q: Are there any new solutions being examined by your team in this space

Damian Gancman, Cityview: Our main focus is on investing in quality product, which helps drive value for investors while reducing risk and mitigating potential defects.

CONCLUSION

Rising insurance costs are taking center stage for Multifamily Investors as premiums continue to increase materially. The increase in premiums is primarily attributed to various factors, including catastrophic risks, location, type of construction, inflation, labor shortages and supply chain issues. In an already challenging investment environment, the uncertainty of future insurance costs in select markets along with higher debt costs and property taxes is another variable for Investors to contemplate in transaction pricing. Additionally, the increasing insurance costs raise more significant concern for Multifamily relative to other property types because the increases cannot be passed directly through to tenants without impacting the ongoing housing affordability issue.

Managers should pursue a comprehensive approach to address insurance needs, including working in partnership with their carriers to mitigate risk, leveraging the resources of their insurance broker and considering working with a third-party insurance or risk consultant. An insurance broker can provide valuable guidance for understanding and designing an insurance strategy offering the optimal cost and risk mitigation combination. Managers must evaluate a broker’s experience and resources to access a breadth of policy options, particularly in challenging market environments. A third-party insurance or risk consultant can provide an independent assessment of whether the insurance coverage is appropriate and the right price and guidance on trends in the insurance industry.