Shanti Ryle

March 10, 2025

The multifamily sector stands at a crossroads. Economic uncertainty, shifting demographic trends, and the evolution of investment strategies are all shaping the landscape. Industry leaders, including Eli Randel, COO of Crexi, Sean Burton, CEO of Cityview, and Daniel Dart, General Partner at Rock Yard Ventures, offer key insights into what stakeholders should anticipate in the year ahead.

A Market Seeking Stability

Coming out of 2024, many expected a more robust commercial real estate recovery, driven by rate cuts and an improving economic outlook. However, inflation proved more persistent than anticipated, leading to a slower-than-hoped-for market rebound. According to Sean Burton, expectations for deeper rate cuts were unmet, delaying the return of liquidity.

“While we didn’t see as much transaction volume as predicted, [Cityview was] able to capitalize on a number of good acquisition opportunities at what we believe were close to the bottom of the market,” Burton said. He anticipates multifamily transaction volume to increase significantly in 2025 as more capital re-enters the market.

Eli Randel, echoes this sentiment, emphasizing that while the market has been slow to recover, fundamentals are pointing toward a new cycle. “While there might still be some messes to clean up, I think in 2025 we’ll start seeing buyers and sellers meeting on pricing, and some of the capital sitting on the sidelines will increasingly be deployed,” he said.

Burton elaborated on Cityview’s approach, emphasizing that detailed market research is central to their investment strategy. As a vertically integrated multifamily investment management and development firm, Cityview relies on data-driven insights to guide its decisions. “We just spent six months working with a market research firm analyzing the 50 biggest markets in the country through 95 different variables,” he said. “We identified key locations where demand far exceeds supply, ensuring that our investments are positioned for long-term stability.” Some markets he highlighted included Austin, Denver, and Seattle.

Daniel Dart, whose VC firm invests in built-world innovation and proptech solutions, had a somewhat more hesitant posture on market recovery, noting that while increased capital flow is expected, the market’s barriers to entry remain a significant challenge. “A lot of people want to build, but the regulatory landscape makes it incredibly difficult. We’ve overcomplicated the process, and until that changes, some markets will remain inaccessible to the smaller, more nimble players,” Dart said.

The Financing Landscape: More Liquidity, But More Competition

The lending environment is showing signs of renewed confidence. As Burton notes, more lenders are re-entering the market, creating heightened competition for deals, especially among a more proven asset class like multifamily. “For well-located, high-quality assets, we are experiencing robust competition among lenders willing to lean in on terms and pricing to win deals,” he explained.

Dart agrees that market conditions are improving and adds that opportunities might face uneven distribution. “The capital is there, but accessibility remains an issue. Big institutional players will move first, but there’s still room for innovative smaller firms who can navigate the current regulatory and financial landscape strategically. Alternative financing models [could] empower local developers who actually understand the communities they’re building in,” he posits.

The wave of loan maturities remains a pressing concern. The Mortgage Bankers Association estimates that over $1 trillion in commercial real estate loans will come due over the next two years. Randel suggests that while lenders have capital to deploy, underwriting standards remain stringent. “Lenders are cautiously loosening underwriting requirements, but demand for multifamily may provide a solid counterbalance for sellers who need to make timely financing-based dispositions. ”

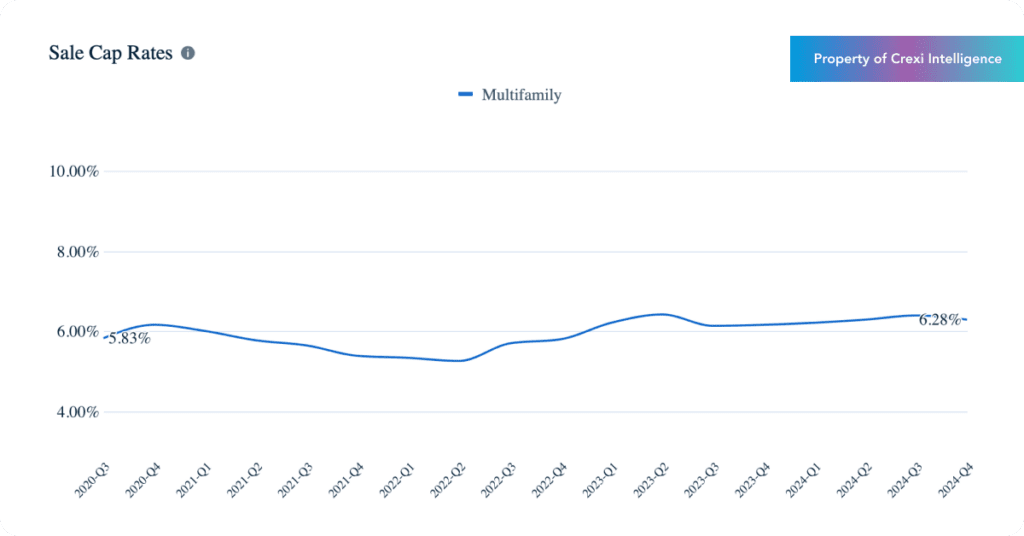

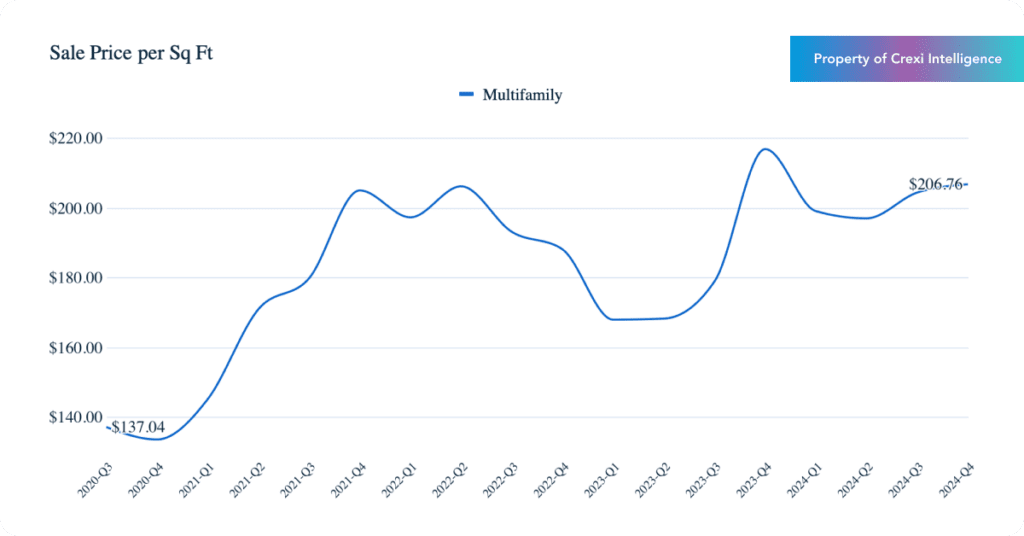

On Crexi, we’re seeing this pick-up in transaction volume in settled cap rates and gradually increasing sale prices on multifamily properties, with sold values up 3.9% over the course of 2024. Demand is still high for residential buildings, and investors are bullish on long-term gains in core markets and willing to spend capital for high-quality assets.

Data source: Crexi Intelligence

Data source: Crexi Intelligence

Multifamily Demand: Vacancy Pressures Versus Long-Term Housing Shortages

One of the most debated topics prior to heading into 2025 was the impact of the recent wave of multifamily completions. While some Sunbelt markets have seen an oversupply of new units, high-barrier-to-entry markets, particularly in the West, remain constrained.

“Housing starts dropped off significantly last year due to rising interest rates and escalating construction costs,” Burton said. “But despite the wave of construction in select markets, there is still a national shortage of housing.”

Cityview’s investment strategy focuses on value-add and core-plus multifamily acquisitions at a deep discount to replacement costs, as well as entitling obsolete office and retail spaces for future residential development. “We have more than 2,500 units in the entitlement pipeline across key Western and Southwestern markets,” Burton noted.

Dart, who invests in pre-seed and seed companies focused on innovating in construction and “the built world”, agrees and pushes even further, noting that the conversation around supply and demand needs to shift. “It’s not just about adding units—it’s about adding the right kind of units,” he said. “There’s a growing population that doesn’t need massive square footage but does need affordability, access to transit, and community-oriented living spaces. The development model needs to shift to reflect that.”

The Suburban Migration Continues

Suburban markets are playing an increasingly critical role in the multifamily sector. Burton highlights that while Cityview has traditionally invested in urban locations, the firm has expanded its focus to inner-ring suburbs.

“People are living differently than they did before COVID, and we’ve moved farther into the suburbs while maintaining our core investment thesis,” he said. This shift aligns with broader demographic trends, as renters seek more space at a lower cost while still prioritizing proximity to employment hubs.

Dart adds nuance to the notion that suburban migration is a dominant force and instead highlights that there’s a healthy desire for single-family home amenities in connected city communities. “I just don’t buy that younger generations are flocking to the suburbs long-term. They want to be where the action is—where jobs, culture, and community thrive. We’re seeing strong demand for urban multifamily, especially in well-connected, transit-oriented developments,” he said.

Technology’s Growing Influence on Multifamily Investing

Technology continues to reshape the commercial real estate industry, driving efficiency in investment strategies, leasing, and asset management. Randel sees technology as a catalyst for making the industry more liquid.

“Historically, selling a property would often take six to nine months or longer from exploration to close. As property discovery and due diligence increasingly become digitized, data sharing is immediate, and underwriting to close speeds up, commercial real estate should become a more liquid asset class,” he said.

Enhanced analytics, virtual property tours, and AI-driven market insights are changing how investors make decisions. As more firms integrate these tools into their workflows, transactions are expected to speed up, reducing friction in the market.

Burton adds that data-driven decision-making has become central to Cityview’s strategy. “We use business intelligence tools to analyze thousands of units across our portfolio. Real-time insights help us optimize operations, improve leasing strategies, and identify trends before they impact the bottom line,” he said.

Dart sees technology as a crucial enabler for smaller developers and players in the industry, as well. “Tech is making it easier for smaller players to compete—whether that’s through AI-driven underwriting tools, automated leasing processes, or predictive analytics that allow for smarter investments,” he said.

The Path Forward: Strategic Investment and Market Discipline

For investors looking to capitalize on 2025’s opportunities, all three experts emphasize the importance of discipline and adaptability. Burton believes that patience and market research will be key to identifying high-conviction investments.

“Our focus remains on markets with strong job growth, where income and population trends signal long-term stability,” Burton said. “We are ensuring that our investments align with long-term trends, rather than short-term speculation.”

Dart, while advocating for innovation, aligns with the sentiment that smart, patient capital will win out. “The firms that succeed won’t just be the ones waiting for market conditions to improve. They’ll be the ones figuring out how to work around them—whether through creative financing, streamlined construction methods, or new zoning approaches,” he said.

As 2025 unfolds, multifamily investors must navigate a landscape defined by shifting capital flows, evolving demographics, and emerging technologies. While challenges remain, those who stay agile and well-informed will find compelling opportunities in the market’s next phase.

Meet the Contributors:

Sean Burton is the CEO of Cityview, a vertically integrated multifamily investment and development firm, where he has worked since 2003. He previously held leadership roles at Warner Bros., O’Melveny & Myers, and the White House, and currently serves on the Metropolitan Washington Airports Authority Board.

Read more: https://www.crexi.com/blog/multifamily-trends-to-watch-in-2025